Issue No. 1

Welcome to our state of tokenised assets issue!

Fintelum operates in Europe, where cryptocurrencies and crowdfunding are accepted methods of fundraising. In this first issue, we bring you some fascinating numbers on the European security token offerings (STOs). And, we conclude with an update on Fintelum.

What gives in European asset tokenisation?

Nothing’s more telling than the sheer number of successfully tokenised projects. Let’s look at STO numbers in EU (i.e., European Economic Area and Switzerland).

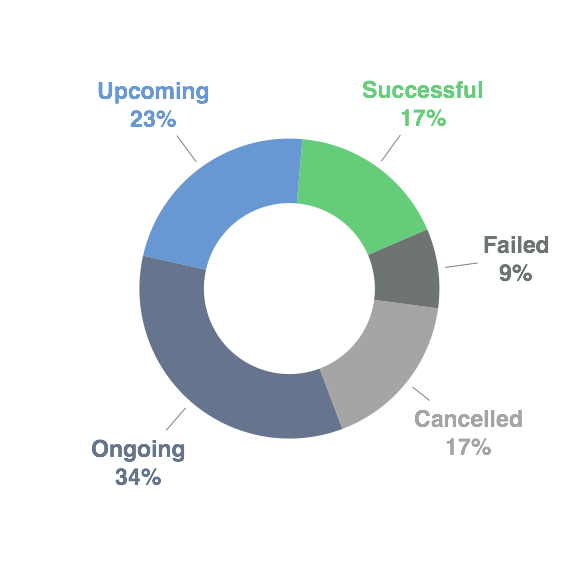

Our research indicates that European tokenisation action has a modest success rate of 41%, wherefrom only 17% of STOs have successfully concluded.

There have been 35 publicly announced strictly STO projects in total. However, only 6 projects have completed successfully, raising at least the minimum target. And, 12 projects are still ongoing. Whereas 9 projects have closed with unsuccessful outcome. Out of these, 3 have failed to raise the minimum threshold, returning the initial investment to investors. And, 6 have been cancelled or abandoned. In all, the allegedly successful projects have raised close to EUR 25 million.

This conclusion is drawn from publicly available information. We have made efforts to confirm related information directly with each issuer.

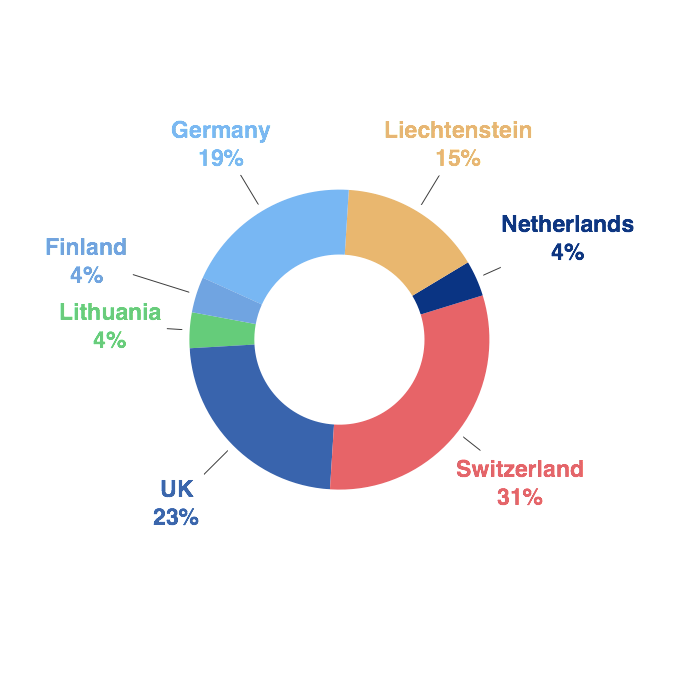

Where are successful & ongoing STOs based?

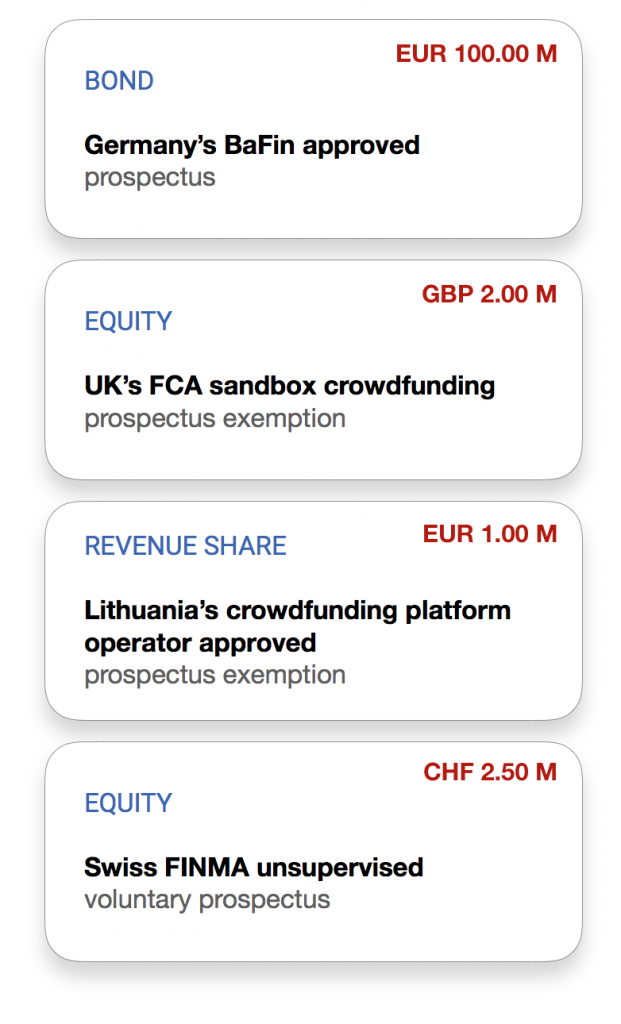

What regulatory basis successful public issuers choose?

Crypto crowdfunding in Europe?

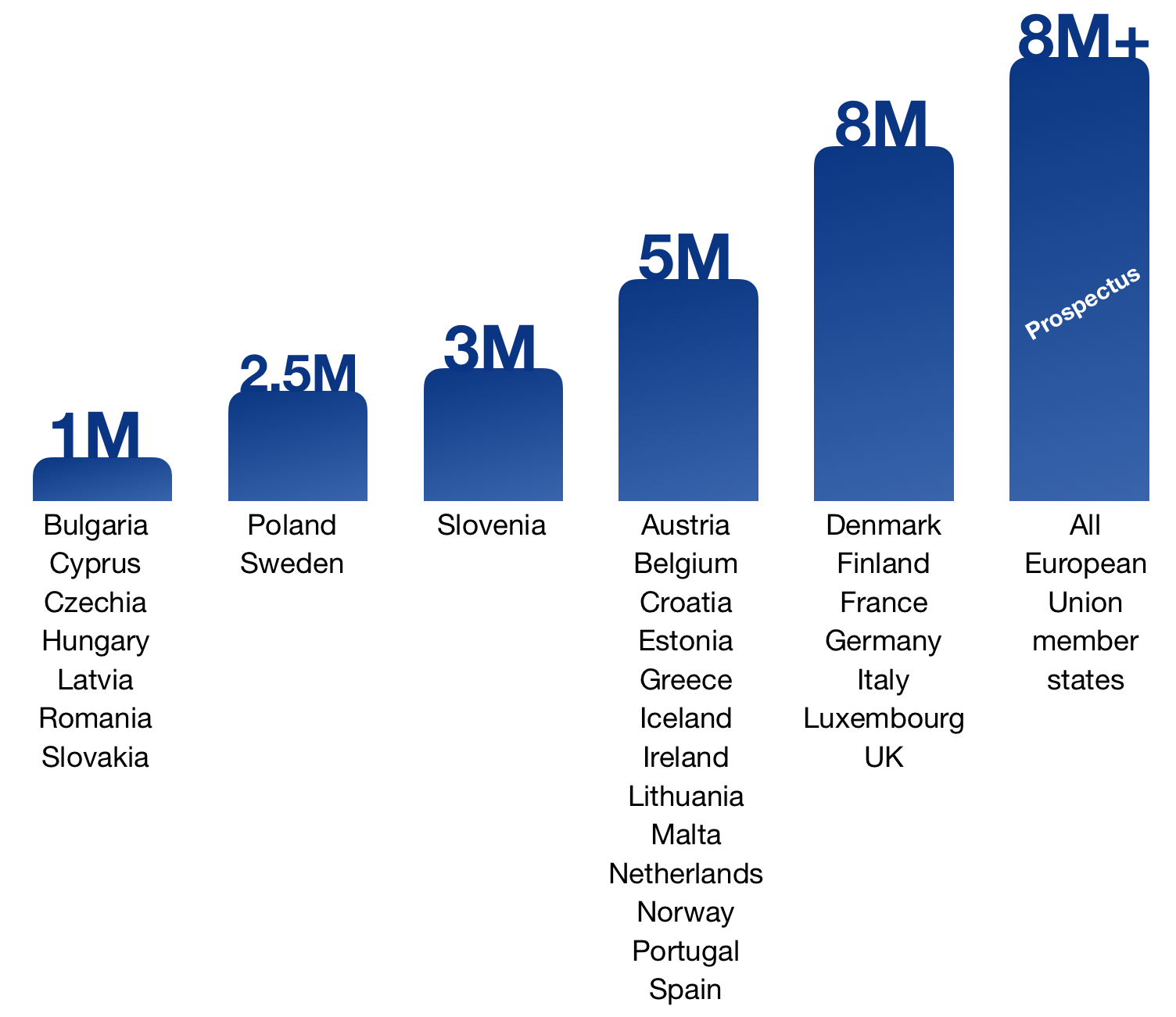

Most of the countries below have not registered a single public STO instance. That said, it does not mean that they cannot. Because, according to Article 3(2) of the EU Prospectus Regulation, Member States may decide to exempt offers of securities to the public from the obligation to publish a prospectus to offers below the following thresholds calculated over a period of 12 months. Therefore, all of the countries below could potentially qualify as target jurisdictions for crypto crowdfunding campaigns:

Where is Fintelum now?

We have been meeting potential tokenisation projects and attending related events. The acquired outcome indicates that tokenisation space is still very new when it comes to securities issuance. There are indeed a handful of securities issuance instances, where the majority account for tokenisation platforms themselves.

Today, we are still in a triple FFF (friends, family and fools) stage for STO industry development at large.

Are you having a hard time raising money? This video is for you!