This is part 3 of a 5 part series. Click here for part 1, or Click Here for Part 2.

Crowdfunding and ICO – a step in evolution of capital markets

ICO acronym abbreviates to “initial coin offering”. But the practice stems from small capital funding method known as the crowdfunding.

In 2009 a US company called Kickstarter launched and successfully continues today to promote and facilitate funding of creative ideas and products. The idea is to pre-sell some product that a creative team pledge to develop or mass produce and deliver to its backers. The practice had no clear legal foundation back when it started. It was only three years later, in 2012, the US law was amended to regulate the new practice of easier access to small capital financing, by adopting Jumpstart Our Business Startups (JOBS) Act.

Similarly, ICO phenomenon sprung up from the burgeoning crypto community. The first ICO is widely accepted to be the Mastercoin blockchain project in 2013. It set itself apart as the first crypto crowdfunding case. The idea was to presell a blockchain coin/token as a service that the team pledged to develop in future. To purchase interest in the project, one was able to pay in bitcoin cryptocurrency. All of a sudden, a new practice was born.

A new use case for cryptocurrencies was forged and started to unfold rapidly. By 2017, not only many new cryptocurrencies emerged, but there were hundreds of ICO projects,

pre-selling their services, often, but not exclusively blockchain-based business applications. Indeed, raising funding in less restrictive way was the prime goal of the practice. Selling a token as interest in the project that had some utility or representation. Hence the new expression – utility token.

By definition, investing in a nebulous utility token (typically Ethereum EIP-20, also known as ERC-20 compliant) had very loose legal obligations, only those pledged by the issuing entity. The investment was not an equity purchase, nor it was a loan, rather – a voluntary contribution. The attraction was an almost immediate liquidity of the newly minted token. After the initial offering, a bubbling secondary market developed and offered easy entry and exit to all participants. Selling a token was selling a promise of a non-existent yet service, not dissimilar to the age of discoveries of long sea voyage ventures.

Similarly, the beginning of 17th century introduced the first permanent joint stock form, where the investment into shares did not need to be returned, but could be traded on a stock exchange.

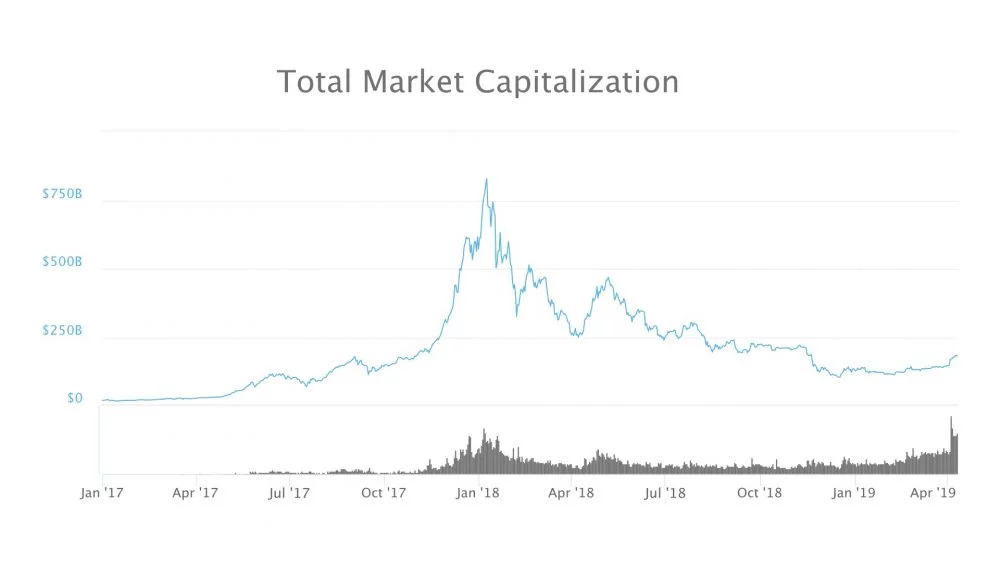

The crypto investment practice unfolded into a wave of ICO projects, culminating in 2017. Thus many startups and mostly white paper ideas got funded. Most were real projects. Some were bad apples. But the most attractive aspect of the ICO were the returns on investments. According to one source, the ROI yielded in excess of 10x, even if you had invested in both the winners and losers alike over the 2017 year. The whole industry was on a steep upwards pressure, with strong interest from the institutional sector. Such returns are unprecedented in the normal trading environment. Fortunes were made and lost.

The year 2017-2018 went down in history as the ICO hype unfolded. It culminated with several major events that occurred at the same time. One was Bitcoin blockchain forking and the subsequent nose dive of most cryptocurrency value. There were other notable events that coincided and contributed to the overall price fall.

From peak to trough the crypto asset market value was at times suddenly and later gradually reduced from over USD800B to little over USD100B. The so called crypto winter had set in. The bittersweet mass interest receded and an immediate flight away from all things crypto ensued. See chart below.

IEO – initial exchange offering

Similarly as with Slack and Spotify exchange listing, there are some ICOs that have listed directly on token exchanges. This way projects can leverage token trading venue client base to showcase their projects directly, without active promotion of the offering through other, often ineffective, marketing channels. This has prompted many token trading venues to start issuing utility token IEOs on behalf of token issuing start-ups.

For the contributors, exchange listing adds trustworthiness, security and vetting, knowing that a reputable exchange, such as Binance will have done certain due diligence before listing an unknown project. Indeed, for utility tokens IEO may prove to be a safe, if not cheap way to gain community trust. It is yet to be seen, however, if the initial listings continue to persist over a longer stretch of time, and what regulatory requirements may be imposed as to listing requirements. This also is a piece of history in the making. Similarly as with Slack and Spotify exchange listing, there are some ICOs that have listed directly on token exchanges. This way projects can leverage token trading venue client base to showcase their projects directly, without active promotion of the offering through other, often ineffective, marketing channels. This has prompted many token trading venues to start issuing utility token IEOs on behalf of token issuing start-ups.

For the contributors, exchange listing adds trustworthiness, security and vetting, knowing that a reputable exchange, such as Binance will have done certain due diligence before listing an unknown project. Indeed, for utility tokens IEO may prove to be a safe, if not cheap way to gain community trust. It is yet to be seen, however, if the initial listings continue to persist over a longer stretch of time, and what regulatory requirements may be imposed as to listing requirements. This also is a piece of history in the making.

Source: https://www.securities.io/security-tokens-or-sto-vs-crowdfunding-icos-ieos-thought-leaders/