We are happy to share that Latvia has become an attractive jurisdiction to carry out security token offerings, thanks to the new prospectus exception amendment. As Fintelum team contributed towards these amendments, the CEO Liza Aizupiete comments:

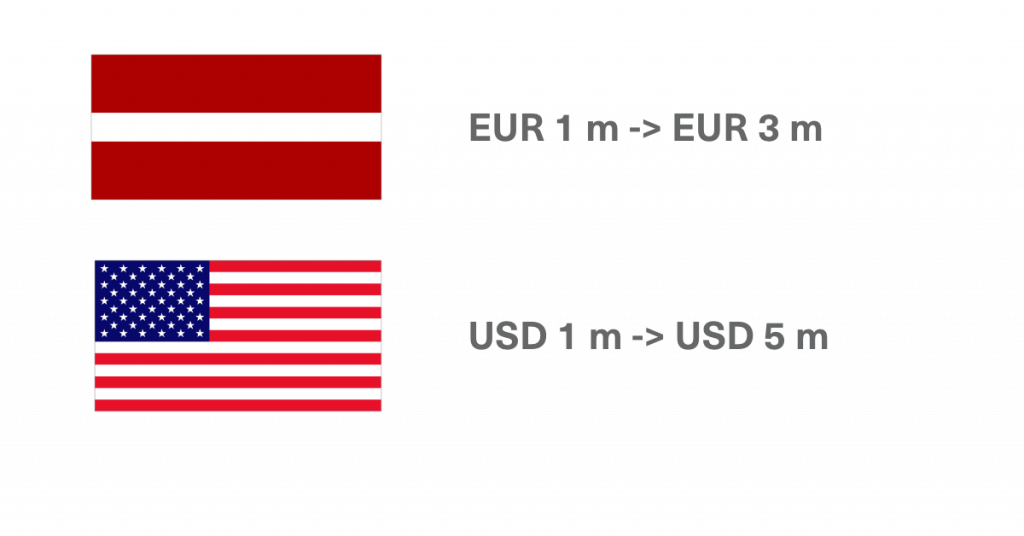

In a bid to help startup and real-estate sectors access better funding options, the present changes to the securities law are making Latvia a more attractive EU member state for capital raising. The present regulatory environment allows Fintelum to serve small and medium-sized enterprises raising up to EUR 3 million, within 36 months, with lower capital markets entry barriers. Investors will be able to invest in fiat or cryptocurrencies and access fractionalized ownership of dividend-yielding projects, open to retail investors. With Fintelum tokenisation and compliance tools, fractional owners of securities, or utility tokens, will be able to swap interest in projects using our peer-to-peer secondary market and thus increase liquidity in typically illiquid assets. For example, if you own a part of a company that owns either a real estate or represents a commercial company, you can digitally buy or sell these fractions among existing shareholders, or you can seek new investors interested in the project.

Coincidentally, the U.S. SEC has also proposed increase to the crowdfunding regulation (Reg CF) maximum capitalisation from USD 1 m to USD 5 m. These two consecutive improvements to the existing laws are a strong indication of positive developments in the crowdfunding and tokenisation scene as well. Also, the Canadian authorities are looking into amending their crowdfunding law. Public consultations are still open.

Do you have a project in mind?